Understanding Personal Loans

Are you in need of a financial boost? Personal loans can be a great solution to help you manage unexpected expenses or achieve your financial goals. In this detailed guide, we will explore everything you need to know about personal loans on discover.cp om, a reliable platform that offers a wide range of loan options.

What is a Personal Loan?

A personal loan is a type of unsecured loan that you can use for various purposes, such as consolidating debt, funding home improvements, or paying for medical expenses. Unlike secured loans, which require collateral, personal loans are based on your creditworthiness and income.

Benefits of Personal Loans

Personal loans offer several benefits, including:

-

Flexible Use: You can use the funds for any purpose, giving you the freedom to manage your finances as you see fit.

-

Fixed Interest Rates: Personal loans typically have fixed interest rates, making it easier to budget and plan for payments.

-

Competitive Interest Rates: Discover offers competitive interest rates, which can help you save money on interest payments.

-

Quick Approval Process: Discover’s personal loan application process is fast and straightforward, allowing you to receive funds quickly.

Eligibility Requirements

Before applying for a personal loan on discover.cp om, it’s essential to understand the eligibility requirements:

-

Age: You must be at least 18 years old.

-

Residency: You must be a U.S. citizen or permanent resident.

-

Income: You must have a steady source of income.

-

Credit Score: While a good credit score can improve your chances of approval, Discover offers loans to borrowers with varying credit histories.

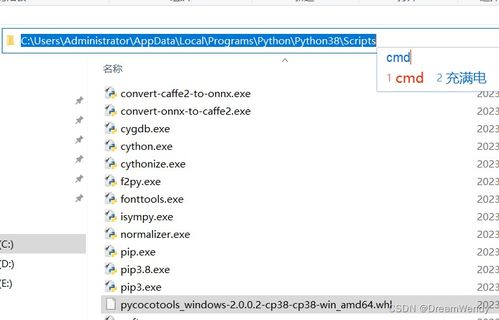

How to Apply for a Personal Loan on Discover.cp om

Applying for a personal loan on discover.cp om is a simple process:

-

Visit the website: Go to discover.cp om and navigate to the personal loans section.

-

Check your rate: Enter your desired loan amount and see the interest rate and monthly payment options.

-

Apply online: Complete the online application form with your personal and financial information.

-

Submit your application: Once you’ve submitted your application, Discover will review it and notify you of the decision.

Understanding the Loan Terms

Before accepting a personal loan offer, it’s crucial to understand the loan terms:

-

Loan Amount: The total amount of money you borrow.

-

Interest Rate: The annual percentage rate (APR) that you’ll pay on the loan.

-

Loan Term: The length of time you have to repay the loan, typically ranging from 1 to 7 years.

-

Monthly Payment: The amount you’ll pay each month to repay the loan.

Repayment Options

Discover offers various repayment options to suit your needs:

-

Automatic Payments: Set up automatic payments to ensure timely repayment.

-

Online Payments: Make payments online through your Discover account.

-

Mobile Payments: Use the Discover mobile app to make payments on the go.

-

Payment Extensions: If you’re unable to make a payment, you may be eligible for a payment extension.

Comparing Personal Loans

When considering a personal loan, it’s essential to compare offers from different lenders. Here’s a table comparing some of the key factors:

| Lender | Loan Amount | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|---|

| Discover | $2,500 – $35,000 | 6.99% – |