Can You Get a Refund on a Credit Card?

When you use a credit card, you expect it to be a convenient and secure way to manage your finances. However, there may come a time when you need to seek a refund for a purchase. But can you get a refund on a credit card? Let’s delve into the details to find out.

Understanding Credit Card Refunds

Credit card refunds are a common occurrence, and they can be initiated in several ways. Before you proceed, it’s essential to understand the different types of refunds and how they work.

- Original Purchase Refund: This is the most common type of refund, where you receive a refund for the exact amount you paid for a purchase.

- Partial Refund: In some cases, you may only be eligible for a partial refund, depending on the terms and conditions of the purchase and your credit card issuer.

- Chargeback: A chargeback is a refund initiated by your credit card issuer when a dispute arises between you and the merchant. This can occur due to unauthorized transactions, goods not received, or dissatisfaction with the product or service.

Now that you have a basic understanding of the different types of refunds, let’s explore the factors that determine whether you can get a refund on your credit card.

Eligibility for a Credit Card Refund

Several factors can affect your eligibility for a credit card refund. Here are some key considerations:

- Merchant’s Policy: The first and most crucial factor is the merchant’s policy. Some merchants may offer refunds within a specific timeframe, while others may not provide refunds at all.

- Credit Card Issuer’s Policy: Your credit card issuer may have specific policies regarding refunds. It’s essential to review your card’s terms and conditions to understand their stance on refunds.

- Timeframe: The timeframe in which you request a refund can impact your eligibility. Some merchants and credit card issuers have strict deadlines for refund requests.

- Reason for Refund: The reason for the refund can also play a role. For example, if you’re requesting a refund due to unauthorized charges, your credit card issuer is more likely to approve the request.

Here’s a table summarizing the eligibility factors for a credit card refund:

| Factor | Eligibility |

|---|---|

| Merchant’s Policy | Varies by merchant |

| Credit Card Issuer’s Policy | Varies by issuer |

| Timeframe | Varies by merchant and issuer |

| Reason for Refund | Varies by reason |

How to Request a Credit Card Refund

Once you determine that you’re eligible for a refund, it’s time to initiate the process. Here’s a step-by-step guide on how to request a credit card refund:

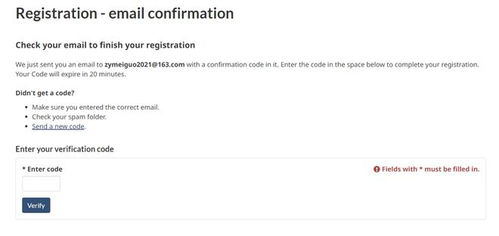

- Contact the Merchant: Reach out to the merchant and explain the situation. Provide any necessary documentation, such as receipts or proof of purchase.

- Wait for Merchant’s Response: The merchant will review your request and determine whether to approve the refund. This process can take a few days to a few weeks.

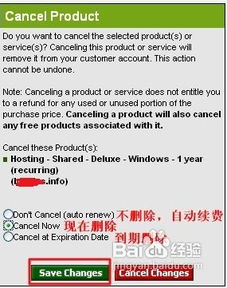

- Contact Your Credit Card Issuer: If the merchant denies your request, or if you’re seeking a chargeback, contact your credit card issuer. Provide them with the necessary information and documentation.

- Monitor Your Account: Keep an eye on your credit card account for any updates on the refund process. This may include a credit to your account or a reversal of the original charge.

Common Refund Scenarios

Understanding common refund scenarios can help you navigate the process more effectively. Here are a few examples:

- Unauthorized Transactions: If you notice unauthorized charges on your credit card statement, contact your issuer immediately. They will