Best Price on Auto Insurance: A Comprehensive Guide for You

When it comes to auto insurance, finding the best price is crucial. It’s not just about saving money; it’s about getting the right coverage for your needs. In this detailed guide, we’ll explore various aspects of auto insurance to help you make an informed decision. Let’s dive in!

Understanding Auto Insurance

Auto insurance is a contract between you and an insurance company. In exchange for paying a premium, the insurance company agrees to cover certain damages and liabilities that may arise from owning and operating a vehicle. It’s essential to understand the different types of coverage available to ensure you’re adequately protected.

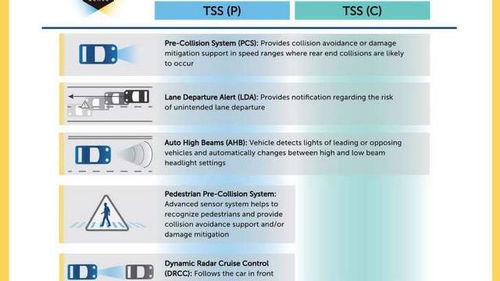

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages and injuries you cause to others in an accident. |

| Collision Insurance | Covers damages to your vehicle in the event of a collision with another vehicle or object. |

| Comprehensive Insurance | Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. |

| Uninsured/Underinsured Motorist Coverage | Covers damages and injuries caused by drivers who are either uninsured or underinsured. |

Factors Affecting Auto Insurance Prices

Several factors can influence the price of your auto insurance. Understanding these factors can help you find the best deal. Here are some key considerations:

- Age and Gender: Younger drivers and males often pay higher premiums due to their higher risk of accidents.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates.

- Location: Insurance rates vary by state and even by city, so where you live can affect your premiums.

- Insurance Company: Different insurance companies have different pricing strategies, so it’s essential to compare quotes from multiple providers.

How to Find the Best Price on Auto Insurance

Now that you understand the basics of auto insurance and the factors that affect prices, let’s discuss how to find the best deal:

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to find the best price.

- Consider Discounts: Insurance companies offer various discounts, such as those for good drivers, students, and bundling policies. Ask about available discounts and see if you qualify.

- Adjust Coverage: Review your coverage needs and adjust your policy accordingly. For example, if you have an older vehicle, you may consider dropping comprehensive and collision coverage.

- Use Online Tools: Many insurance companies offer online tools to help you compare quotes and find the best price.

- Read Reviews: Look for reviews of insurance companies to ensure you’re dealing with a reputable provider.

Final Thoughts

Finding the best price on auto insurance requires research and comparison. By understanding the different types of coverage, factors affecting prices, and how to find the best deal, you can make an informed decision that saves you money and provides adequate protection. Remember to shop around, consider discounts, and adjust your coverage as needed. Happy driving!