Understanding AnnualCreditReport.com: A Comprehensive Guide

When it comes to managing your credit, having access to accurate and up-to-date information is crucial. One of the most reliable sources for such information is AnnualCreditReport.com. This platform offers a variety of services that can help you monitor your credit score, dispute inaccuracies, and make informed financial decisions. Let’s delve into the details of what AnnualCreditReport.com has to offer.

What is AnnualCreditReport.com?

AnnualCreditReport.com is a government-mandated website that provides consumers with free access to their credit reports from each of the three major credit bureaus: Equifax, Experian, and TransUnion. This service is designed to help you stay informed about your credit standing and to ensure that your credit reports are accurate.

How to Access Your Credit Reports

Accessing your credit reports on AnnualCreditReport.com is a straightforward process. Here’s a step-by-step guide:

- Visit AnnualCreditReport.com and click on the “Request Your Free Annual Credit Reports” button.

- Enter your personal information, including your name, address, Social Security number, and date of birth.

- Answer a series of security questions to verify your identity.

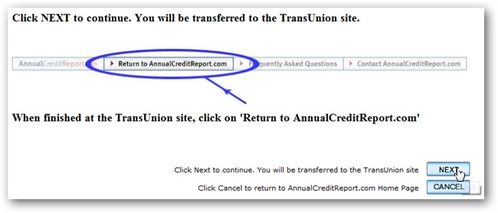

- Select the credit bureaus from which you want to receive your credit reports.

- Review your credit reports and look for any errors or discrepancies.

It’s important to note that you are entitled to one free credit report from each of the three bureaus every 12 months. This means you can access your reports at different times throughout the year to keep a close eye on your credit.

Understanding Your Credit Reports

Your credit report contains a wealth of information about your credit history, including:

- Personal Information: Your name, address, Social Security number, and employment information.

- Account Information: Details about your credit accounts, such as the type of account, the date it was opened, the credit limit, and your payment history.

- Public Records: Information about any liens, judgments, or bankruptcies that may affect your credit.

- Hard Inquiries: A record of any recent credit inquiries made by lenders when you apply for new credit.

Understanding the information on your credit report is essential for identifying potential issues and taking steps to improve your credit score.

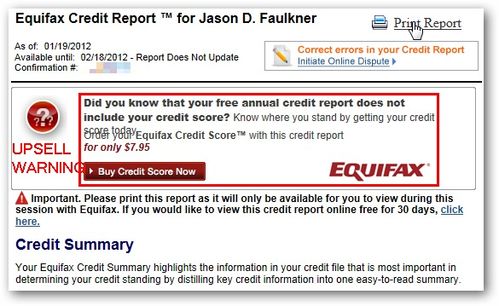

Disputing Errors on Your Credit Reports

It’s not uncommon to find errors on your credit reports. If you discover an error, you can dispute it using AnnualCreditReport.com. Here’s how:

- Log in to your account on AnnualCreditReport.com.

- Select the credit bureau from which you received the erroneous report.

- Click on the “Dispute” link next to the item you want to dispute.

- Follow the instructions to provide details about the error and submit your dispute.

It’s important to keep a record of your dispute and follow up with the credit bureau to ensure that the error is corrected.

Monitoring Your Credit Score

In addition to providing access to your credit reports, AnnualCreditReport.com also offers a free credit score estimate. While this is not your actual credit score, it can give you a general idea of where you stand.

Monitoring your credit score can help you identify potential issues before they become major problems. If you notice a significant drop in your score, it may be a sign that you need to take action to improve your creditworthiness.

Additional Resources

AnnualCreditReport.com offers a variety of resources to help you manage your credit, including:

- Education Center: A wealth of information on credit scores, credit reports, and financial management.

- FAQs: Answers to common questions about credit and credit reports.

- Tools and Calculators: Tools to help you calculate your debt-to-income ratio, estimate your credit score, and more.

By utilizing these resources, you can gain a better understanding of your credit and take steps to improve it.

Conclusion

AnnualCreditReport.com is an invaluable resource for anyone looking to manage their credit effectively. By providing free access to your credit reports and score,