TurboTax.com: Your Ultimate Guide to Tax Preparation

Are you tired of the hassle of tax preparation? Do you find yourself overwhelmed by the complexity of tax laws and regulations? Look no further! TurboTax.com is here to simplify your tax experience. In this comprehensive guide, we will delve into the various aspects of TurboTax.com, from its user-friendly interface to its wide range of features. Get ready to make tax preparation a breeze with TurboTax.com.

Understanding TurboTax.com

TurboTax.com is an online tax preparation software designed to help individuals and businesses file their taxes accurately and efficiently. It is developed by Intuit, a leading provider of financial management and tax software. With over 40 years of experience, Intuit has made tax preparation accessible to everyone, regardless of their financial expertise.

How Does TurboTax.com Work?

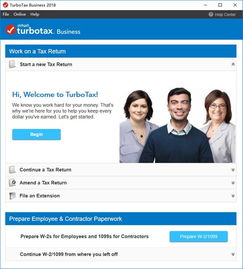

Using TurboTax.com is a straightforward process. Here’s a step-by-step guide to help you get started:

-

Visit TurboTax.com and create an account.

-

Select the tax form that best suits your needs.

-

Answer a series of questions about your income, deductions, and credits.

-

TurboTax.com will guide you through the process, ensuring you don’t miss any deductions or credits.

-

Review your tax return and e-file it for free or print it out and mail it.

Features of TurboTax.com

TurboTax.com offers a wide range of features to make tax preparation easier and more accurate. Here are some of the key features:

-

Step-by-Step Guidance: TurboTax.com walks you through the entire tax preparation process, ensuring you don’t miss any important information.

-

Smart Lookups: This feature allows you to import your W-2 and 1099 forms directly into your tax return, saving you time and reducing errors.

-

Maximize Your Refund: TurboTax.com helps you identify all possible deductions and credits to ensure you get the maximum refund.

-

Live Tax Expert Support: If you have questions or need assistance, TurboTax.com offers live tax expert support to help you every step of the way.

-

Mobile App: Access your tax return and get updates on the go with the TurboTax mobile app.

Types of TurboTax.com Plans

TurboTax.com offers different plans to cater to various tax situations. Here’s a breakdown of the available plans:

| Plan | Description | Price |

|---|---|---|

| Free Edition | Best for simple tax returns with no itemized deductions. | Free |

| Deluxe Edition | Best for itemized deductions and credits, such as mortgage interest and property taxes. | $39.99 |

| Premier Edition | Best for investment income, rental property, and self-employment income. | $59.99 |

| Self-Employed Edition | Best for self-employed individuals with business income and expenses. | $89.99 |

Benefits of Using TurboTax.com

Using TurboTax.com offers several benefits, including:

-

Accuracy: TurboTax.com’s advanced algorithms ensure your tax return is accurate and error-free.

-

Security: TurboTax.com uses industry-standard encryption to protect your personal and financial information.

-

Time-Saving: TurboTax.com